Recent Commercial Posts

Don't Wait for Disaster: The Value of a Commercial Emergency Ready Plan (ERP)

4/1/2025 (Permalink)

Call SERVPRO of West Vancouver Clark County today for any of your commercial cleanup and restoration needs (360) 695-4418

Call SERVPRO of West Vancouver Clark County today for any of your commercial cleanup and restoration needs (360) 695-4418

At SERVPRO of Vancouver East-West Clark County, we understand that in the unpredictable world of business, being prepared for the unexpected is paramount. A Commercial Emergency Ready Plan (ERP) isn't just a document; it's a lifeline that can minimize downtime, protect assets, and safeguard your team when disaster strikes right here in our community.

Imagine a sudden flood, a devastating fire in your commercial building, or a severe windstorm impacting your business. Without a clear, localized plan, chaos ensues. An ERP, tailored to the unique risks of Vancouver and Clark County, provides a structured approach, outlining critical steps to take before, during, and after an emergency. It's about proactive preparation, not reactive scrambling.

An effective ERP, and one that we at SERVPRO of Vancouver East-West Clark County can help you develop, details evacuation routes specific to our area, contact information for key personnel and local emergency services, procedures for data backup and recovery, and protocols for communicating with employees and clients. It also addresses the crucial aspect of restoration, detailing preferred vendors like SERVPRO of Vancouver East-West Clark County, who are ready to swiftly mitigate damage and get your business back on track.

The value of an ERP extends beyond immediate response. It minimizes financial losses by reducing downtime and preventing further damage. It protects your reputation by demonstrating responsible management. And, most importantly, it ensures the safety and well-being of your employees and our community. Investing time in developing a comprehensive, locally-focused ERP with SERVPRO of Vancouver East-West Clark County is an investment in your business's resilience. Don't wait for disaster to strike – plan today for a safer, more secure tomorrow, with SERVPRO of Vancouver East-West Clark County.

Commercial Water Damage

5/1/2024 (Permalink)

Water damage is a threat to the safety of occupants, and the finances of the owners, but not just of residential homes, but commercial buildings as well. In Vancouver, Washington that means plenty of retail stores, banks, and the other commercial structures. In times of severe flooding or plumbing failure, this damage could even stop your business from performing daily tasks, which halts daily business, causing you to lose money.

Here, are some basic preventative and responsive best practices that tenants of commercial buildings can use to get back to business quickly.

Preventative Measures

There are things you can do to minimize the damage due to water leaks in a commercial environment. First, educate your office managers on water damage preparedness. This includes having your managers learn how to turn off the water, electric, and gas supply. If you don’t have access to these things, then they should know who to call to have such things done. It’s also a good idea to have some basic tools in the office in the event of an emergency. Lastly, have a list of emergency contact phone numbers for all employees so that in the worst-case scenario the loved ones of those injured can be notified. Of course, you should already have the contact information for your local fire and police numbers, so that anyone who is injured can get medical attention if needed.

Response

Just as with residential structures, rapid response is critical to water damage in an office. The longer water is in an affected the area the more of a chance there is that it will be affected by mold, which is another problem altogether.

The best course of action is:

- Call a plumber to fix the source of the loss;

- Call your insurance and file a claim if necessary.

- Call SERVPRO of Vancouver to remediate the damage. (360) 254-0049

Commercial Water Damage

5/24/2023 (Permalink)

One of our Crew Chief's, Alex, working hard cleaning up damage left behind by commercial water damage

One of our Crew Chief's, Alex, working hard cleaning up damage left behind by commercial water damage

Water damage is a common problem that can occur in commercial buildings. It can be caused by a variety of factors including floods, leaks, burst pipes, and storms. When water damage occurs it can cause significant damage to the building and its contents. In this blog post, we will discuss the importance of addressing water damage in commercial buildings and the steps that should be taken to mitigate the damage.

The Importance of Addressing Water Damage in Commercial Buildings

Water damage can have a significant impact on commercial buildings. It can cause structural damage, mold growth, and damage to equipment and inventory. Mold growth, for example, can cause respiratory problems and other health issues. Therefore, it is important to address water damage as soon as possible to prevent further damage and ensure the safety of those who work in the building.

Steps to Mitigate Water Damage in Commercial Buildings

- Identify the Source of the Water Damage

The first step in mitigating water damage is to identify the source of the water. This could be a leaky roof, burst pipe, or flooding. Once the source of the water is identified, steps can be taken to stop the water from entering the building.

2. Remove Standing Water

If there is standing water in the building, it should be removed as soon as possible. This can be done using pumps or wet vacuums. The longer the water sits the more damage it can cause.

3. Dry the Area

After the standing water has been removed; the affected area should be dried as quickly as possible. This can be done using fans, dehumidifiers, and other drying equipment. It is important to ensure that the area is completely dry to prevent mold growth.

4. Clean and Disinfect

Once the area is dry it should be cleaned and disinfected. This will help to prevent mold growth and remove any bacteria or other contaminants that may be present.

5. Repair and Restore

Finally any damage that has been caused by the water should be repaired and restored. This may include replacing damaged drywall, flooring, or other materials. It is important to ensure that the repairs are done correctly to prevent future water damage.

Water damage can have a significant impact on commercial buildings. It is important to address water damage as soon as possible to prevent further damage occurring or to reduce the risk of mold growth.

Maintaining Your Commercial Building to Avoid a Water Damage

8/18/2022 (Permalink)

Our goal first and foremost is to inform you on how to prevent a water damage but we will be there day or night if you do!

Our goal first and foremost is to inform you on how to prevent a water damage but we will be there day or night if you do!

Pay special attention to areas of the building where leaks are most likely to occur:

- HVAC system

- Toilets, faucets, and plumbing system

- Windows

- Building foundation

- Sewers

- Sprinkler systems

Document the age and maintenance records for all building systems. Knowing your building equipment’s age – and having them regularly serviced and updated – can save you time and money down the road. It can also help you keep track of equipment warranties.

Your first sign of a water issue could be in your water bills. A small 1/8” crack in a pipe loses 250 gallons of water in a single day.

Signs of a water leak include:

- Dark or wet spots

- Cracking, bubbling, or flaking drywall, plaster, or wallpaper

- Pooling water or puddles

- Dampness or humidity in the air

- Sounds of dripping or gushing water

Consider installing a water sensor monitoring system at your business. There are different models and options available.

Commercial Damage Have you Puzzled?

6/9/2022 (Permalink)

Remain positive and hopeful because SERVPRO of E. Vancouver is here to help 24 hours a day, 365 days a year!

Remain positive and hopeful because SERVPRO of E. Vancouver is here to help 24 hours a day, 365 days a year!

Natural disasters can cause significant and costly damages to homes, roads and, of course, local businesses. While you should always be prepared for such events, by maintaining adequate insurance coverage and secure file backups, you sometimes get little warning before disaster strikes. And if something happens, you'll want to get your business back up and running as quickly as possible.

Unfortunately, the road to recovery isn't always easy. A previous article about recovery from 2012's Superstorm Sandy reported that just 25 percent of small businesses had backups of critical programs and data before the storm, and even fewer (20 percent) said they had protected their buildings from the storm or prepared emergency survival kits.

Execute your business continuity plan

Your business continuity plan should prepare you for major disaster scenarios, such as the loss or unavailability of IT systems, key people or a facility third party. Make sure key personnel will have access to the plan on secured mobile devices immediately after a disaster.

Don't have a business continuity plan?

Check your backed-up data

You should have already backed up and safely stored your most critical data: your business license, major contracts and legal documents, tax returns and financial statements, and other critical business and customer documents. Following a disaster, make sure your vital records are still securely accessible from the devices you're using.

Communicate with your employees and external parties

Leverage your website, social media channels and text messaging to reach your employees, customers, partners and vendors. Reassure your customers that you're still in business, while making sure that no communications will inadvertently create legal liability or adversely affect service-level agreements.

Contact your insurance company

Once you and your employees are safe and accounted for after a disaster, survey the damage. Contact your insurance company to file a claim. You should always do an occasional check-up to ensure you have adequate coverage for major disaster types, including cybersecurity insurance. Office break-ins and vandalism may occur during a disaster, and if someone steals computer equipment or paper documents containing personally identifiable information, and the information was not encrypted, you may have a legal requirement to notify your customers. To be safe, encrypt your customer data, digitize paper documents and store all critical data in a secure, cloud-based document-management system.

If your insurance doesn't cover the full cost of the damage, you may be eligible for a disaster loan from the Small Business Administration of up to $2 million. The SBA may even provide working capital loans, even if you didn't have any property damage.

Prepare Your Business for Potential Disaster

5/25/2022 (Permalink)

You can be ready or you can be ruined! Consider our Emergency Ready Plan services at no cost, call (360) 254-0049

You can be ready or you can be ruined! Consider our Emergency Ready Plan services at no cost, call (360) 254-0049

While you never expect your Vancouver, WA, commercial building to be affected by fire, it may be a good idea to prepare for the potential disaster. Fire preparation can help you know what to do should a fire break out on your property. Use these tips to prepare.

Train Employees

One of your biggest concerns during a fire should be the people inside of your building. Make sure your employees or tenants know how to get out of the building by holding regular fire evacuation trainings. You should post evacuation plans around the property to ensure everyone knows the best way out.

Consider Restoration

Part of preparation has to be centered around the potential fire damage your building could sustain. How are you going to take care of roof damage, scorched equipment or structural problems? Finding a trusted fire restoration specialist now can make your repair process much simpler when an emergency hits.

Have a Contingency

Depending on what your business does, a fire could shut down your company for a time. Part of your disaster preparation plan may be how you deal with a potential halt of work. You can get insurance to help cover financial losses or rent a temporary workspace to reduce the downtime.

Create an Inventory

Your fire preparation plan should also include a list of the equipment, records and property you have in your commercial building. Knowing what's there before a disaster can make creating a loss list for your claim easier. Take pictures of your building, figure out the cost of your equipment and record your inventory.

Install Safety Equipment

Smoke alarms, fire sprinklers and other safety equipment can help mitigate the damage done by a fire. Installing these tools before a disaster is often a good idea.

Fire preparation might be the last thing on your mind. However, if your commercial building is ever affected by flames, you'll be happy you took the time to prepare.

Commercial Water Damage

5/11/2022 (Permalink)

Download our app so you can contact us quickly!

You can also save our 24/7 number (360) 254-0049

Download our app so you can contact us quickly!

You can also save our 24/7 number (360) 254-0049

There’s no such thing as a small disaster especially when the water you don’t see contains bacteria or can cause mold, rot and other unseen damage. Water damage can affect the value of your property. Before you get out the mop bucket and try to clean it yourself, consider how the damage can affect your property.

SERVPRO of Vancouver/ Clark County knows how disruptive water damage can be for your business. SERVPRO is trained and equipped to manage the drying process. By utilizing the proper equipment and moisture measuring devices, your building will be quickly and thoroughly dried to industry standards, which will help prevent secondary water damages. With rapid response time and a full line of water cleanup and restoration services, SERVPRO can help you regain control quickly, ensuring your facility and its contents are properly dried, deodorized and protected.

Before you risk further damaging the value of your facility by attempting to clean up the mess yourself, call the professionals at SERVPRO of Vancouver/Clark County for water damage cleanup and restoration.

The Importance of Renters Insurance

3/11/2022 (Permalink)

For questions regarding renters insurance, or to schedule an inspection contact SERVPRO of W. Vancouver Clark Co. @ (360) 254-0049

For questions regarding renters insurance, or to schedule an inspection contact SERVPRO of W. Vancouver Clark Co. @ (360) 254-0049

One of the most common mistakes that tenants make is assuming that their landlord’s insurance will cover their belongings in the event of loss or damage. In addition, tenants may think that renters’ insurance is too expensive. However, the common myths associated with renters’ insurance that keep tenants from purchasing it can end up costing much more in the long run.

Importance of Renters’ Insurance

It’s imperative to always read the fine print in your lease. You may assume that your landlord is liable for damages caused by leaky roofs or broken appliances, but there could be a clause in your lease that negates landlord liability, such as for theft, or injuries to a guest visiting your apartment. Also, your lease may require you to obtain renters’ insurance, especially if you live in an expensive apartment. Regardless of whether or not it’s required, here are some common situations when renters’ insurance can really come in handy. According to Effective Coverage renters insurance in Washington costs around $15.00 a month for most people. That's basic coverage of $10,000 of personal property and $100,000 of liability. "Only 37 percent of renters have renters insurance whereas 95 percent of homeowners have a homeowners insurance policy, according to a 2014 I.I.I. poll conducted by ORC International." - Insurance Information Institute

Natural Disasters

If your rental home and property is damaged because of a natural disaster, such as wildfire, hail, or tornado, the landlord may or may not repair the home damages, but your personal property usually isn’t covered. Renters’ insurance will protect you in the event that a natural disaster occurs, but keep in mind that a few natural disaster coverage options are considered “riders,” which means they are add-on coverage, such as earthquakes, volcanic eruptions, floods, and hurricanes.

Unnatural Fires of Short-Circuit Damage

Fires due to electrical issues and short circuit damage may or may not be covered by your landlord. In most cases, it will depend upon the fine print in your lease. If it’s not covered by your landlord, you’ll be liable for smoke and fire damage not only to your own belongings, but to the property as well. If you live in a multi-dwelling building and the fire spreads to other tenants’ apartments, you could be liable for damages to their belongings as well any property damage to their dwelling.

Commercial Water Damage

1/20/2022 (Permalink)

Call us day or night!

Call us day or night!

There’s never a convenient time for flooding or water damage to strike your business. Every hour spent cleaning up is an hour of lost revenue and productivity. So when an emergency situation arises in your business, give us a call and we’ll be there fast with the help you need.

- 24 Hour Emergency Service

- Faster to Any Size Disaster

- A Trusted Leader in the Restoration Industry with over 1,700 Franchises

- Highly Trained Water Damage Restoration Specialists

Commercial Water Restoration Presents Unique Challenges

SERVPRO of W. Vancouver / Clark Co. has the training, experience, and equipment to handle large commercial flooding or water damage emergencies. Whether your water emergency occurs in a small office building or big box store, we will respond quickly to mitigate the damage and manage the restoration project through to its completion.

Locally Owned Company with National Resources

SERVPRO of W. Vancouver / Clark Co. can respond immediately to your commercial water damage emergency regardless of the size or scope of the damage. We are part of a national network of over 1,700 Franchises with special Disaster Recovery Teams placed strategically throughout the country to respond to large scale events and disasters.

Let Us Help With Your Commercial Construction Projects

1/20/2022 (Permalink)

We want to minimize your downtime and loss of revenue!

We want to minimize your downtime and loss of revenue!

SERVPRO is your one-stop shop for commercial construction. While running the daily functions of your business, the last thing you want to worry about when you have a need for restoration or reconstruction is contacting and managing multiple repair crews. We’ll work with your insurance company to restore your commercial property to help make it “Like it never even happened.” Our goal is to complete your commercial restoration project on time and within the budget with as little downtime to your business as possible. SERVPRO has competent and experienced professionals that believe in delivering quality workmanship. Our full-service process includes: inspection and estimating, mitigation, restoration and reconstruction. We also offer premium services for dust control and protection from COVID-19 and other contaminants using our proprietary, EPA-registered products.

Minimize Your Commercial Water Damage by Calling SERVPRO

12/15/2021 (Permalink)

It was all hands on deck at this shoe store!

It was all hands on deck at this shoe store!

Despite being right on the Columbia River, much of the flooding Vancouver businesses deal with is much more mundane. Common water intrusion problems include failed sprinklers, broken pipes, and backed-up plumbing.

To support Vancouver business owners and reduce commercial water damage, SERVPRO specialists train to perform several key tasks. They have to stop the flow of water, make repairs where possible, and dry the inventory. For a small, retail operation like a bike shop, our Water Restoration Technicians (WRTs) break it down like this:

First, they turn off the water. If possible, that means shutting off the flow to only the problem so that the owner can still use the other areas of her business and perhaps even reopen to customers. If a pipe burst close to the water inlet, however, the WRTS need to shut off the water for the entire operation.

For minor issues such as a pipe connection, or a split hose leading into a commercial sink, they can quickly make those repairs in a few hours. For major issues, the team leader may recommend bringing in a licensed plumber. In this operation, WRTs use long-handled squeegees to push water off the floor and out the nearest exit or floor drain.

With the water stopped, other SERVPRO team members move in to dry inventory on the shelves. They place drying pads underneath to soak up water and install height-adjustable fans to increase air circulation and the evaporation process. To increase the efficiency of the air movers, WRTs also install dehumidifiers to draw water from the air. This action also helps to speed up evaporation and mitigate damage or prevent loss to inventory parts and the danger of rusting.

For bikes and other inventory on the floor, team members can bring in racks to help dry them in place, or remove them outside to take advantage of the drier air and connect fans to a portable generator to dry them as quickly as possible.

If your business has a problem with recent or not-so-recent water intrusions, call SERVPRO of W. Vancouver / Clark Co. at (360) 254-0049. We are here to help you reopen for customers as quickly as we can return your shop to its original, dry condition.

Prepare Your Business For Colder Weather

10/18/2021 (Permalink)

Invest in your business by preparing for the unknown.

If you incur a water damage, call our 24/7/365 office at (360) 254-0049

Invest in your business by preparing for the unknown.

If you incur a water damage, call our 24/7/365 office at (360) 254-0049

When you think of flooding in commercial buildings, your mind may turn to heavy rains.

Downpours are a common cause of water damage in buildings. However, rain flooding isn't the only cause of indoor floods in Vancouver, WA. Cold weather can lead to standing water on your property due to a burst pipe.

Why Pipes Freeze

Pipes often freeze when the weather gets extremely cold. Not all plumbing that transports water has the same risk of freezing. Some piping may freeze more often:

- Uninsulated plumbing in exterior walls

- Outdoor sprinkler lines

- Pipes in unheated spaces, like garages, attics or basements

- Exterior hose bibs

These particular pipes often aren't heated, so when the cold weather strikes, the water within freezes. The freezing action causes the water within to expand, which is why some plumbing may burst open.

What to Do If Pipes Freeze

A frozen pipe does not necessarily have to turn into a burst pipe. If you catch the problem early enough, you may be able to thaw the water before it becomes a problem.

First, open a faucet to give the thawed water somewhere to go. Next, locate the frozen stretch by looking at the suspects listed above. Finally, apply warmth to the pipe using a hair dryer, towel soaked in warm water or another soothing form of heat. If a pipe does burst, you may need to call in a water restoration expert for help taking care of the water damage.

How to Avoid Frozen Pipes

Because no one wants to deal with flooding in his or her business, you may want to take some precautionary steps. You can keep a trickle of water running through faucets or spigots because running water can help stave off freezing. Keep the heat on in the building even if no one will be using it for a while.

You can't always stop storm damages from taking place in your commercial building. If you're unable to stop a burst pipe from happening to you, you at least know who to call for help.

Commercial Water Damage Course of Action

7/14/2021 (Permalink)

We're Here to Help! Just call our 24/7/365 hotline to dispatch our team that is "Faster to any Size Disaster,"

We're Here to Help! Just call our 24/7/365 hotline to dispatch our team that is "Faster to any Size Disaster,"

Water damage is a threat to the safety of occupants, and the finances of the owners, but not just of residential homes, but commercial buildings as well. In Vancouver, Washington that means plenty of retail stores, banks, and the other commercial structures. In times of severe flooding or plumbing failure, this damage could even stop your business from performing daily tasks, which halts daily business, causing you to lose money.

Here, are some basic preventative and responsive best practices that tenants of commercial buildings can use to get back to business quickly.

Preventative Measures

There are things you can do to minimize the damage due to water leaks in a commercial environment. First, educate your office managers on water damage preparedness. This includes having your managers learn how to turn off the water, electric, and gas supply. If you don’t have access to these things, then they should know who to call to have such things done. It’s also a good idea to have some basic tools in the office in the event of an emergency. Lastly, have a list of emergency contact phone numbers for all employees so that in the worst-case scenario the loved ones of those injured can be notified. Of course, you should already have the contact information for your local fire and police numbers, so that anyone who is injured can get medical attention if needed.

Response

Just as with residential structures, rapid response is critical to water damage in an office. The longer water is in an affected the area the more of a chance there is that it will be affected by mold, which is another problem altogether.

The best course of action is:

- Call a plumber to fix the source of the loss;

- Call your insurance and file a claim if necessary.

- Call SERVPRO of Vancouver to remediate the damage. (360) 254-0049

Why Renters Insurance is Crucial

6/1/2021 (Permalink)

Home disasters are hard enough already, you don't have to go through this alone, we are here to help 24/7!

Home disasters are hard enough already, you don't have to go through this alone, we are here to help 24/7!

One of the most common mistakes that tenants make is assuming that their landlord’s insurance will cover their belongings in the event of loss or damage. In addition, tenants may think that renters’ insurance is too expensive. However, the common myths associated with renters’ insurance that keep tenants from purchasing it can end up costing much more in the long run.

The Importance of Renters Insurance

It’s imperative to always read the fine print in your lease. You may assume that your landlord is liable for damages caused by leaky roofs or broken appliances, but there could be a clause in your lease that negates landlord liability, such as for theft, or injuries to a guest visiting your apartment. Also, your lease may require you to obtain renters’ insurance, especially if you live in an expensive apartment. Regardless of whether or not it’s required, here are some common situations when renters’ insurance can really come in handy. According to Effective Coverage renters insurance in Washington costs around $15.00 a month for most people. That's basic coverage of $10,000 of personal property and $100,000 of liability. "Only 37 percent of renters have renters insurance whereas 95 percent of homeowners have a homeowners insurance policy, according to a 2014 I.I.I. poll conducted by ORC International." - Insurance Information Institute

Natural Disasters

If your rental home and property is damaged because of a natural disaster, such as wildfire, hail, or tornado, the landlord may or may not repair the home damages, but your personal property usually isn’t covered. Renters’ insurance will protect you in the event that a natural disaster occurs, but keep in mind that a few natural disaster coverage options are considered “riders,” which means they are add-on coverage, such as earthquakes, volcanic eruptions, floods, and hurricanes.

Unnatural Fires of Short-Circuit Damage

Fires due to electrical issues and short circuit damage may or may not be covered by your landlord. In most cases, it will depend upon the fine print in your lease. If it’s not covered by your landlord, you’ll be liable for smoke and fire damage not only to your own belongings, but to the property as well. If you live in a multi-dwelling building and the fire spreads to other tenants’ apartments, you could be liable for damages to their belongings as well any property damage to their dwelling.

For questions regarding renters insurance, or to schedule an inspection contact SERVPRO of W. Vancouver/ Clark Co. (360) 695-4418

Your Recent Water Damage Resulted in Mold

5/17/2021 (Permalink)

If you had a recent water damage, call SERVPRO of W. Vancouver/ Clark Co. for a thorough inspection. Our 24/7 line is (360) 695-4418

If you had a recent water damage, call SERVPRO of W. Vancouver/ Clark Co. for a thorough inspection. Our 24/7 line is (360) 695-4418

Your commercial property in East Vancouver, WA, can easily become a breeding ground for mold growth. Even with regular inspection and maintenance, mold problems can still occur. Excess dust and moisture can linger in hidden places and combine forces to cause a fungal infestation that can only be remedied by mold remediation experts. Here are the top four places mold likes to hide in commercial buildings.

Carpet

Carpet has many crevices where mold spores can hide and many surfaces to which it is easy for mold to adhere. While you can't prevent all spills and can't always control how well people clean up after themselves when they do spill, you can dehumidify the room by increasing air flow to the area. This can help dry out the carpet and prevent mold growth.

Ceiling Tiles

Ceiling tiles are often made of porous material, which allows mold to take root. Watch out for water damage in ceiling tiles and get it fixed as fast as possible. It only takes a day or two for mold to start to grow in places where leaks have occurred. Because the growth usually starts on the side of the tile that is hidden, it can become a big problem before it is noticed.

Walls

Walls present the same difficulty that ceiling tiles do. The moisture problem contributing to the mold issue is often inside the wall and thus can become significantly moldy long before it is detected. When this happens, it is best to let remediation experts handle the problem to ensure it is resolved completely.

Air Ducts

The dust in air ducts can attract mold spores and give them a place to grow. When coupled with high humidity, the mold problem gets larger. Regular cleaning and maintenance of the HVAC system is necessary to detect or prevent mold problems in the ducts.

Since mold spores are everywhere, you can't always prevent mold growth. You can, however, stop the problem before it gets out of hand if you are vigilant. For more information, head to our commercial mold remediation page.

Protecting Your Business

5/11/2021 (Permalink)

With SERVPRO on your side you can protect you business from everyday dangers. We have a 24/7 Emergency Response team to be there when it matters most.

With SERVPRO on your side you can protect you business from everyday dangers. We have a 24/7 Emergency Response team to be there when it matters most.

The SERVPRO Emergency READY Profile Advantage

As many as 50% of businesses close down following a disaster, according to the latest research. Of the businesses that survive, the overwhelming majority of them had a preparedness plan in place. Pre-planning can serve as an insurance policy aimed at peace of mind. And knowing you are "Ready for whatever happens" speaks trust to your clients and employees that in the event your business is affected by a disaster, they don’t necessarily have to be.

By developing a SERVPRO Emergency READY Profile for your business, you minimize business interruption by having an immediate plan of action. Knowing what to do and what to expect in advance is the key to timely mitigation and can help minimize how water and fire damage can affect your business.

- A no cost assessment of your facility.

This means there is no need to allocate funds, giving you a great value at no cost.

- A concise Profile Document that contains only the critical information needed in the event of an emergency.

It will only take a little time to complete and will not take you away from current projects. But it will save a lot of time if ever needed.

- A guide to help you get back into your building following a disaster.

This can help minimize the amount of time your business is inactive by having an immediate plan of action.

- Establishes your local SERVPRO Franchise Professional as your disaster mitigation and restoration provider.

You have a provider that is recognized as an industry leader and close by.

- Identification of the line of command for authorizing work to begin.

This saves time so we can begin the work of mitigating the damage which can save you time and money.

- Provides facility details such as shut-off valve locations, priority areas and priority contact information.

Having a quick reference of what to do, how to do it and who to call provides solutions in advance of an emergency so that during the emergency you are "Ready for whatever happens."

Contact us today to schedule this complimentary service and protect your business!

(360) 254-0049

Preparing Your Commercial Property in Spring

3/22/2021 (Permalink)

If your business does encounter any damage, don’t hesitate to call our office day or night!

If your business does encounter any damage, don’t hesitate to call our office day or night!

Many commercial building owners think that just because temperatures outside get warmer, the potential hazards of winter pass. A spring thaw can easily cause flooding in your building in downtown Vancouver, WA, however, if you are not prepared. Make sure your building is ready from the bottom to the top for those Pacific Northwest April showers.

1. Basement Preparation

The basement or lowest floor of your building is susceptible to a spring flood as soon as winter snow and ice start melting. In addition to taking the appropriate measures to keep water out, such as having your foundation inspected, you should also complete and check the following items off your list:

• Purchase an automatic sump pump

• Install flood sensors

• Elevate sensitive machinery off the floor

2. Plumbing Protection

A frozen pipe can burst even when it starts warming back up. If the temperature change is too sudden, the pipes may not be able to withstand the contrast. Keep the thermostat in your building set to at least 55 degrees all the time so that your pipes are still kept safe overnight.

3. Roof Inspection

The beginning of spring is a great time to have your roof professionally inspected. Contractors can identify damage and other weak spots, and water restoration specialists can remediate any leaks that occurred during the winter.

4. Drainage Clearing

Falling leaves and twigs that get blown into gutter and downspouts during the winter need to be cleared out before spring rains begin. When a spout is clogged, rain must find another path off the building, and it is usually not the path you would prefer. Clean your drainage system completely so that rainwater has somewhere to go.

When you see ice and snow melting, you know it’s time to prepare your building for warmer weather. Following these tips can help ensure a smooth transition from winter to spring and keep your building from flooding.

COVID-19 and your Business

1/18/2021 (Permalink)

Call about our after hours cleaning services so we don't disrupt your work day! (360) 254-0049

Call about our after hours cleaning services so we don't disrupt your work day! (360) 254-0049

The number of confirmed COVID-19 cases has sent us all on a roller coaster ride this year. We begin to feel relieved as we see a decline in cases, only to stress out again when we see case numbers rise throughout the holidays. One thing that has been consistent is the number of business owners reaching out to learn more about our Certified: SERVPRO Cleaned Program. We've developed plans for all types of businesses to help them keep their staff and patrons safe. The Certified: SERVPRO Cleaned Program provides business owners and their patron's peace of mind when they see our logo on the front door. They can tell and feel that the space has had a high level of cleaning. We sanitize all high touch areas.

Stores, restaurants, office buildings, and commercial buildings are great candidates for the Certified: SERVPRO Cleaned Program. Please call SERVPRO of Vancouver/ Clark County for more information on the Certified: SERVPRO Cleaned Program.

Common Causes Of Commercial Water Damage

1/13/2021 (Permalink)

SERVPRO is here for you when your commercial building experiences water damage

SERVPRO is here for you when your commercial building experiences water damage

Whenever anyone visualizes water damage, most think of a massive storm taking out power lines, flooding structures, and shutting down businesses for days at a time. While it is true that commercial water damage is often the result of floods due to water that stems from weather events and storms, many forget that storms aren’t the only causes of flooding and water damage.

Here are some of the additional and common causes of water damage to commercial buildings.

Malfunctioning sprinkler systems

Many older office, retail and warehouse buildings still have outdated sprinkler systems which work in conjunction with fire protection systems. While those types of sprinklers can come in handy during a fire emergency, they can also cause commercial flood damage if they are faulty or in need of replacement. This could easily damage inventory, business assets, flooring and the building structure.

Broken pipes and plumbing

Just like in a your home, if the plumbing system in your workplace fails water damage could be the result.

Backed up sewer lines

Should the sewer line to your building back up or become damaged, realize the potential dangers of contaminated Black Water which can cause health effects and ruin products and office furnishings.

Damaged appliances and equipment

This cause of commercial flood damage is more common in restaurants and catering facilities, as well as any business that has appliances and equipment that make use of water. If the appliance fails and sends water across your building, especially during hours when no one is around, you may come back to work and walk into a severe water emergency.

If your business has suffered commercial water damage then we are here for you. Just call us, SERVPRO of Vancouver/ Clark County. We are available 24/7 and 365 to assist.

Bringing Value to your Business

12/15/2020 (Permalink)

Call and ask about our Covid-19 Cleaning Services! #HereToHelp just dial (360) 254-0049

Call and ask about our Covid-19 Cleaning Services! #HereToHelp just dial (360) 254-0049

With the changing times, businesses have changed and so have the customer expectations. Now people expect more quality service and value-added products.

Here are a few reasons that will help you understand how SERVPRO Of Vancouver/Clark County’s Commercial Cleaning Services are the better option when it comes to a clean and hygienic workplace.

Better, Faster Cleaning Services

Though faster is not always better, in this particular case it is. We excel in the art of cleaning a premise comprehensively at a professional pace. We manage it by using high tech cleaning equipment covering more area in lesser time and by training our staff to make maximum use of their time and technology.

Competition Among Rival Cleaning Services

One good thing that has happened in recent times is that due to highly competitive prevailing market conditions the benefit of the resulting higher cleaning standards has gone in favor of the customer. Now you have the option of getting better quality services at highly competitive prices.

After Hours Cleaning Service

The biggest advantage of hiring SERVPRO of Vancouver/ Clark County is that you can have the work done after or before your office working hours. What this means is that you get a clean workplace without the hassles of your staff being disturbed during the work hours.

Value-Added Services

Like any other business, SERVPRO has added more diversity to their mainstream cleaning business. They now offer value added services such as water damage restoration, fire damage restoration, sanitizing, and mold remediation and so on.

Commercial Water Damage: Prevention and Response

10/23/2020 (Permalink)

At SERVPRO® of Vancouver/Clark County we are the leaders of commercial water damage restoration. Contact us today to learn more!

At SERVPRO® of Vancouver/Clark County we are the leaders of commercial water damage restoration. Contact us today to learn more!

Severe floods, cold spells or internal plumbing failures can cause water damage that brings your business to a standstill. The impact is immediate on employees as well as the bottom line. There are Preventive Measures that mitigate the impact of these emergencies and commercial restoration services to assist with the proper Response.

Preventative Measures

In the office environment, there are some things you can do to minimize the risk of damage due to water leaks.

- It is beneficial to educate your office managers on water damage preparedness

- This means that your managers should know how to turn off the water, electric, and gas supply

- They should know who to call in order to have these items completed.

- Keep basic tools in the office in the event of an emergency

- Create and maintain a list of emergency contact phone numbers for all employees

- Maintain contact information for your local fire and police numbers for medical emergencies

Response

Rapid response is critical to water damage in the office. The longer you wait before the area is restored mold can develop creating the need for commercial mold removal services.

The best immediate course of action is to:

- Call a plumber to fix the source of the loss

- Call SERVPRO® of Vancouver/Clark County to remediate the damage

Of course, you can call your insurance first, but recall we are experts at the insurance side of damages and can help you get the best coverage

Restoring Your Water Damaged Downtown Vancouver Commercial Property

7/17/2020 (Permalink)

Commercial water damage present unique challenges, but SERVPRO has created unique solutions. Call to schedule an inspection (360) 254-0049

Commercial water damage present unique challenges, but SERVPRO has created unique solutions. Call to schedule an inspection (360) 254-0049

Flooding and water damage events in commercial properties are often complex with numerous issues that require a knowledgeable and flexible response. Whether we’re dealing with a relatively small water cleanup scenario or a large scale event, we work quickly to assess each unique situation and isolate the damaged area. In many instances, normal operations can continue in a temporary space while we restore your facility.

Restoring Commercial Properties Presents Unique Challenges

Our professionals are trained to be mindful of legal and environmental concerns and strive to fully restore the damaged area while working within your budgetary constraints. We understand that every hour spent cleaning up is an hour of lost revenue and productivity. So when an emergency situation arises in your business, give us a call and we’ll be there fast with the help you need.

About SERVPRO of Vancouver/ Clark County

SERVPRO of Vancouver/ Clark County specializes in the cleanup and restoration of commercial and residential property after a water damage event. Our staff is highly trained in property damage restoration. From initial and ongoing training at SERVPRO’s corporate training facility to regular IICRC-industry certification, rest assured our staff is equipped with the knowledge to restore your property.

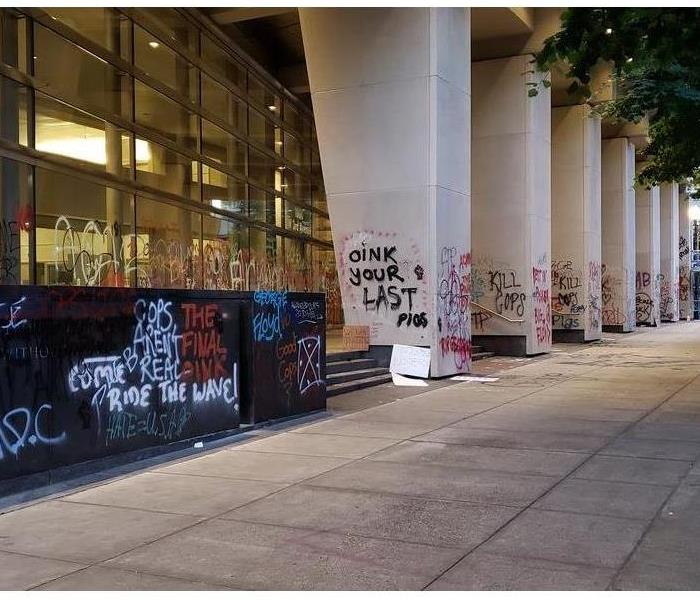

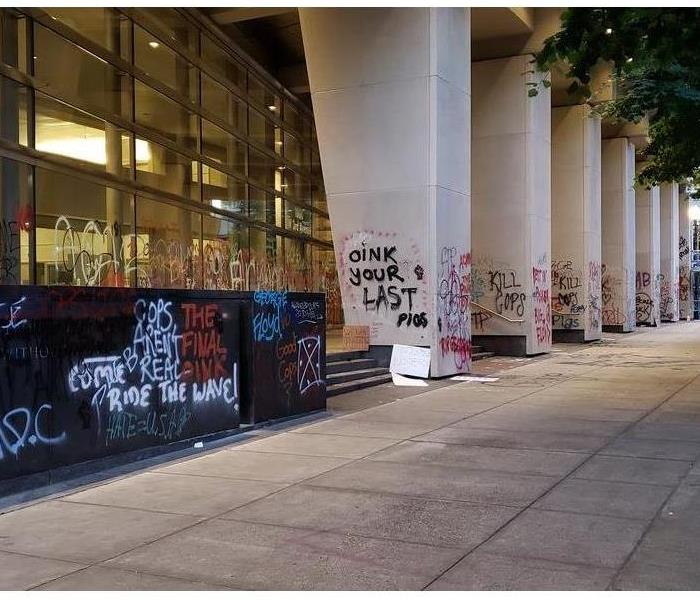

Vandalism and Graffiti Cleanup

6/1/2020 (Permalink)

If you need help with cleaning up after vandalism, call the professionals (360) 254-0049

If you need help with cleaning up after vandalism, call the professionals (360) 254-0049

As a property owner, vandalism is always a concern. One common form of vandalism is spray-painted graffiti. This is often applied to concrete walls, driveways, metals, wood, glass or plastic materials.

If your residential or commercial property is vandalized with graffiti, you may think it will be impossible to bring back to its original condition. However, SERVPRO of Vancouver/Clark County is equipped to clean graffiti from any surface.

Here are a few factors to keep you educated on graffiti and how it can impact your building.

- If you notice graffiti on your commercial building, give SERVPRO a call ASAP! The longer the paint sits, the harder it is to take off.

- The outside temperature makes a difference in the graffiti removal process. The colder the weather, the more difficult it is to remove the paint as it bonds with the cold wall. Warmer weather makes it much easier to remove.

- The cleaning agent used to remove graffiti makes a huge difference. You can trust SERVPRO to use the appropriate cleaning agents to remove all signs of spray paint. Our talented experts will restore your building and make it "Like it never even happened."

SERVPRO of Vancouver/Clark County specializes in the cleanup and restoration of residential and commercial property after vandalism, storm, smoke, mold, or any other damaging event. Our staff is highly trained in property damage restoration. From initial and ongoing training at SERVPRO’s corporate training facility to regular IICRC-industry certification, rest assured our staff is equipped with the knowledge to restore your property.

How To Survive A Commercial Fire

5/18/2020 (Permalink)

We're ready to get your commercial property in pristine condition, so call us now at (360) 254-0049

We're ready to get your commercial property in pristine condition, so call us now at (360) 254-0049

Although running a business can be personally rewarding and professionally advantageous, corporate leaders often find themselves grappling with challenging situations such as a commercial fire damage. If your commercial property is subjected to fire, you can experience emotional upset, structural damage, health hazards, and challenges ensuring the safety of your employees. However, learning how to implement proven tips and tricks that help you grapple with the aftermath of a fire can limit and even eliminate these frustrations. With that idea in mind, consider implementing the following four strategies when you find yourself dealing with a property fire:

1. Call A Fire Damage Remediation Company.

As soon as the fire department is through extinguishing the flames, you should contact a fire damage remediation company. In many cases, property owners who undergo a fire are tempted to complete the cleanup and repair process for themselves. Don't do this. Commercial Fire damage remediation specialists possess the extensive education, experience, and equipment necessary to complete the restoration process quickly and correctly. If you attempt to do this work yourself, you can expose yourself to health hazards and compromise the safety of your employees.

2. Get Your Records Together.

In addition to calling a commercial fire damage remediation remediation company, it's crucial that you get your records together. This means that you will need to create an inventory list and take pictures of damaged items. This information should be presented to your insurance agent to ensure that you attain as much coverage as possible for repair costs. Also, note that it's a good idea to purchase a fireproof safe where you can store records. It's also prudent to regularly backup your computer records and then store them on a hard drive in the safe.

3. Call Your Insurance Company.

Calling your insurance company is a must following a commercial fire. As mentioned earlier, you'll need to present them with records and documentation indicating the depth and scope of damages. In addition to determining how much coverage you will attain, the insurance company may be able to refer you to a highly qualified fire damage remediation company like SERVPRO of Vancouver/Clark County.

4. Attain Approval To Re-enter The Property.

Don't assume that it is safe to reenter your property after a fire. In some cases, there may be sanitation issues, health hazards, or structural weaknesses that make reentry unsafe. For this reason, it's important that you attain permission to reenter from the fire department or another authoritative figure.

Call SERVPRO For Excellent Fire Damage Remediation Services

Once a commercial fire strikes your property, attaining professional fire damage remediation services is a must. With over 50 years of industry experience and a team of passionate, IICRC-certified professionals, SERVPRO of Vancouver/Clark County is your first and only choice for expedient, efficient remediation services. We offer excellent customer service, use cutting edge equipment, and keep our clients informed during each stage of the remediation process.

Battle Fruit Valley Commercial Water Damage With The Help of Your Local SERVPRO

5/14/2020 (Permalink)

You can reach our SERVPRO of Vancouver/Clark County’s rapid response team anytime by calling (360) 254-0049.

You can reach our SERVPRO of Vancouver/Clark County’s rapid response team anytime by calling (360) 254-0049.

When your warehouse faces the effects of water damage, it is time to contact SERVPRO for mitigation services.

The Costs of Water Restoration for Your Fruit Valley Warehouse

As a Clark County business owner, your primary focus for the company is doing things efficiently so that you are not cutting too deeply into potential profits when something goes wrong. A water loss incident in the facility can put your items at risk. While you no doubt have a capable custodial staff, water loss incidents often require a fast response from trained professionals like ours to prevent unnecessary future damages.

Even smaller scale incidents that only require water cleanup services for your warehouse can still get done inadequately, which poses a significant risk to the contents of the building and the structure itself. Our SERVPRO team can work to provide you with the most cost-effective and efficient solutions for immediate mitigation to prevent loss and for the full cleanup and restoration of any existing damages.

Effective water removal is often the first step in this process once our team arrives at your facility after the incident. We can bring in portable pumps and other advanced extraction equipment to remove excess water quickly from the affected areas. This removal provides the opportunity for our SERVPRO technicians to assess the damage to structural elements and contents, even opting to remove items from the facility for a short time to protect them against potential damages while restoration work gets underway.

Excessive water damage often comes with cleanup duties, and our training in restoration work allows us to provide commercial customers with premier cleaning services that can return their facility to its original condition quickly. Whether it is the carpeted office space within the building or concrete flooring out on in the shop and storage areas, we have the advanced equipment and expertise to make it “Like it never even happened.”

We can respond quickly to a water damage emergency in your warehouse to help protect its contents and prevent unnecessary expenditures or prolonged restoration processes.

Be Prepared for Fire Damage to Your Commercial Business

3/24/2020 (Permalink)

If you are interested in learning more about what we can do for your property after a fire, look no further. Call us today at (360) 254-0049

If you are interested in learning more about what we can do for your property after a fire, look no further. Call us today at (360) 254-0049

A commercial fire damage can leave some or all areas of your property unusable until repair work can be completed. When your workplace has been impacted by a fire, you will want to get repairs started as quickly as possible so that the property can be restored to preloss condition so you can get back to business. Finding the fastest and most reliable method of fire damage restoration is crucial. Your business operations downtime must be kept to a minimum.

Determining the Scope of the Work

When you are dealing with a commercial fire damage, the scope of work that needs to be accomplished starts with a thorough assessment. The destruction generally includes more than just burned damage to the structure, business equipment and documents. In many instances, smoke, as well as water from the firefighters' efforts, will ruin one or more areas of the property. Smoke damage may be present throughout the entire property in some cases.

Exploring Repair Options

Many steps may be required to improve the property after you have experienced a commercial fire damage. For example, you may need to remove drywall that has been damaged by smoke or water from the fire event. You may also need to have the carpeting, business fixtures, and upholstered surfaces professionally cleaned. Some areas may need to be fully reconstructed, such as those that have been burned by the flames. When you are preparing for fire damage repair services, it is important to consider all aspects of the work that needs to be done before you decide how to proceed. Then call SERVPRO of Santa Barbara. Your time and lost business revenue should be of paramount importance. Business interruption insurance can help you overcome this event.

Getting Timely Results

While you need all of the work completed with professional results, you also need them performed promptly so that operations can resume in full swing as soon as possible. You could attempt to contract with different service providers to repair the various types of damage on the property, but this is often not the most efficient method available. Working with one company like SERVPRO of Vancouver that has the skills and experience to handle all aspects of the repair process may be the most effective option available. From the initial inspection to the final walk-thru, your doors will be reopened as soon as possible.

When your commercial building in Salmon Creek or Hazel Dell has suffered fire damage, you may grapple with what steps you need to take to get the property repaired and operations back up and running again soon. SERVPRO of Vancouver offers professional fire damage repair services for commercial properties, and we are the local company that you trust to respond to requests for emergency service without delay.

Your Local SERVPRO

1/20/2020 (Permalink)

A water damage comes suddenly and you need a company that you can count on to arrive just as quickly.

A water damage comes suddenly and you need a company that you can count on to arrive just as quickly.

There’s no such thing as a small disaster-especially when a small leak now could blossom into a big claim later. Unseen water can soak through walls, seep through carpet and pool on subfloors, causing major problems over time. You need help-fast. No matter what time of day or night, contact SERVPRO of West Vancouver/ Clark County to begin emergency mitigation. Emergency mitigation means that under normal circumstances, SERVPRO of West Vancouver/Clark county can be on site within four hours to begin drying your building and restoring contents. The faster the water is removed, the less chance of serious damage to your facility. Every SERVPRO franchise professional Is trained and understands how to manage the drying process. By utilizing state of the art equipment and the latest technology, your structure will be quickly and thoroughly dried, which helps prevent secondary water damages.

SERVPRO will remove moisture and any contaminants by disinfecting and deodorizing to safely clean and dry your building and contents. Help ensure the value of your property by calling your local SERVPRO of West Vancouver/ Clark County.

Commercial Business Fire in Bagley Downs Neighborhood

1/15/2020 (Permalink)

This small business experienced an electrical fire in the ceiling which would devastate any business owner who didn't know who to call.

This small business experienced an electrical fire in the ceiling which would devastate any business owner who didn't know who to call.

The first 48 hours after a fire damage can make the difference between restoring versus replacing damaged property and personal belongings. Rapid response and timely mitigation can help prevent fire damage from creating long-term problems.

SERVPRO of West Vancouver/ Clark County understands returning to normal is your primary concern. SERVPRO response teams are trained in caring for both you and your property. By responding quickly with a full line of fire cleanup and restoration services SERVPRO of West Vancouver/ Clark County can help you get your business back up and running quickly and help protect your property and belongings.

If your business suffers a fire damage, contact SERVPRO to make it “Like it never even happened.”

2020 Resolution: Plan Ahead

12/27/2019 (Permalink)

Call SERVPRO of Vancouver/ Clark County to establish your Emergency READY Profile and be "Ready for whatever happens" in 2020.

Call SERVPRO of Vancouver/ Clark County to establish your Emergency READY Profile and be "Ready for whatever happens" in 2020.

With each new year, many people resolve to better themselves or some part of their life. This year, make a resolution to be ready. No one ever plans on a disaster, but you can prepare for it. The SERVPRO Emergency Ready Profile (ERP) will help ensure you are “Ready for whatever happens” in 2020.

In the event of an emergency, the ERP can help minimize business interruption by having an immediate plan of action in place for your facility. The ERP is a comprehensive document containing critical information about your business, including emergency contacts, shut-off valve location and priority area. The ERP also contacts SERVPRO of Vancouver/ Clark County as your disaster mitigation and restoration provider, giving you access to over 45 years experience and a system more than 1700 franchises strong. ERP is a no-cost assessment; all it requires is a little time, making it a great value that could save you time and money in the future. By downloading the free SERVPRO READY App, this information is stored electronically and can be accessed using your mobile device putting help at your fingertips.

Preparation is the key to making it through any size disaster, whether it is a small water leak, a large fire or an area flood. Having a plan in place may help minimize the amount of time your business is inactive and get you back in the building following a disaster. Don’t wait until disaster strikes-resolve to be ready.

Your Business: Ready or Ruined?

10/29/2019 (Permalink)

This facility was affected by both fire and water damage. We called all hands on deck to get this business up and running again in no time.

This facility was affected by both fire and water damage. We called all hands on deck to get this business up and running again in no time.

Technology can now be a vital tool in preparing for emergencies or disasters, as well as during or after to stay informed of the situation and in communication with others. From common technology you already use on a day-to-day basis to taking a few extra steps to prepare, the following will help you be ready in the event of an emergency or disaster. Store Information Online There are many places to store important information securely online. Services like Google Drive and Dropbox offer a free way to store different types of files, from a word document to images of important documents. Ready.gov suggests saving an electronic version of insurance policies, identification documents, medical records, and information on your pets, if necessary. Follow the News Stay informed by following agencies such as FEMA, local news channels, and local government on Twitter for the most up-to-date information in a disaster situation. You can also alert first responders if a rescue as needed through Twitter. Mark Yourself Safe The American Red Cross offers a safe & well check inside to list yourself as safe or find family and friends in situations where communication is difficult to establishFacebook also has a feature called safety check that is activated after natural disasters or a crisis. You will receive a notification from Facebook if you’re located in the affected area at that time. Get in Touch Make sure your contact information is up-to-date in your phone and email for communication with family, friends, business contacts, and others whom you may need to get in contact with before, during, or after a disaster. Charge Up Keep a portable charger in your car and home in case of an emergency. You may need to recharge this from time to time, but you can also buy solar powered chargers as well. Get an Emergency Ready Profile SERVPRO of West Vancouver/Clark County is proud to offer Emergency READY Profiles (ERP) for free at ready.SERVPRO.com to help prepare you, your property, or your business for an emergency.By developing a SERVPRO Emergency READY Profile for your property or business, you minimize business interruption by having an immediate plan of action. Knowing what to do and what to expect in advance is the key to timely medication and can help minimize how water and fire damage can affect your property or business.put help in the palm of your hand with the ReadyPlan app. Get in touch with SERVPRO of West Vancouver/Clark County for more information on developing an ERP for your property or business, and SERVPRO will be there to help make it “Like it never even happened.”

An Education on How Water Damage Affects Vancouver Schools

7/23/2019 (Permalink)

We want to help your water damage so that you can keep school in session.

We want to help your water damage so that you can keep school in session.

Crucial Steps to Deal with Commercial Water Damage in Your Vancouver School

Water spills that happen in your school can be accidental or even acts of truancy by some students. However, what matters once the incident happens is the steps you take to mitigate the loss, and restore normalcy. Stopping the water source fast helps ease the other steps that follow. Although the janitorial staff and other workers can manage some aspects of the loss, involving a professional team helps guarantee thoroughness.

The intensity of a commercial water damage incident in Vancouver schools depends on how it unfolds. If a main supply line bursts, it can release vast amounts of water within a short while even when you manage to stop the source quickly. A spill that happens in the middle of the night can also go unnoticed for a long time, leading to widespread damage. We help you deal with disasters when they occur. Our SERVPRO team can also help you prepare a proper response plan that your staff and restoration teams can follow when there is a loss. We do this by creating a digitized ERP, Emergency Ready Profile, which can be promptly accessed.

With the large open hallways in a school setting, water from a single source can spread over vast areas. Although the spilled water may not damage the materials in the halls easily, it exposes the students and everyone else to the risk of slip and fall accidents. Fast extraction of the standing water is therefore necessary. Our SERVPRO team can handle such expedited water extraction using truck-mounted water extractors and wet vacs.

Water loss incidents can damage building materials in the walls and the ceiling if the spill originates from an elevated source. Restoration in such cases requires controlled tear-down of the affected areas to remove all damaged materials and access any water that finds a way into concealed cavities. Our SERVPRO technicians have the expertise to make flood cuts and punch vent holes or weep holes without causing unnecessary damages.

For a faster and thorough restoration of water damage in your Salmon Creek, Ridgefield or La Center school, call SERVPRO of W. Vancouver / Clark Co. to help. You can reach us at (360) 695-4418 any time. We’re Faster To Any Size Disaster.

More about Vancouver.

How Commercial Water Loss Incidents Affect Offices in Vancouver

6/13/2019 (Permalink)

SERVPRO can dry your office and get you back in the business of doing business.

SERVPRO can dry your office and get you back in the business of doing business.

Unique Challenges that Commercial Water Damage in Vancouver Office Buildings Can Present

Managing a building with offices may not present many unique challenges since most of the tenants follow predictable routines in their daily activities. However, a water loss incident in such premises can cause great inconvenience and leave a significant restoration bill if you do not respond appropriately. We offer professional restoration services in Vancouver that can help shield you from significant loss.

The large open hallways common in many office blocks can present a challenge after water damage in Vancouver. Without facing any physical barriers, spilled water can spread to a broader area lengthening the extraction process. If there is significant foot traffic in the building, the damage can spread even further. One way to overcome this challenge is by using sophisticated extraction equipment, which eases the removal process. Our SERVPRO technicians use different extraction equipment such as ride-on high volume extractors, which carry the technicians as they remove water reducing the work strain.

The materials used on floors and other surfaces in office complexes can present challenges after water spills. Carpets can absorb vast amounts of water while joints on tiles can allow seepage leading to issues such as mold development. Removing the floor materials to extract water is useful but can lengthen the period it takes to restore the property to preloss condition. Our SERVPRO technicians use sophisticated equipment to facilitate extraction without removing the floor materials. For example, combining a water claw and with a portable or truck mounted water extractor allows us to extract water from a carpet in place. We also have injecti-dry systems that ease the removal of water trapped beneath hard surfaces such as wood or tiles.

Water loss incidents lead to soiling in different areas as the water and people moving around the building spread debris from one area to another. Thorough cleaning is necessary to restore sanitary conditions in the building. Our SERVPRO technicians use multi-surface scrubbers and professional cleaning agents to remove all forms of soiling.

To overcome any challenges after a water loss in your office building, call SERVPRO of W. Vancouver / Clark Co. You can reach us at (360) 695-4418 any time. We're Faster To Any Size Disaster.

Read more about Vancouver here.

3 Steps To Remove Mold From Air Ducts

4/12/2019 (Permalink)

SERVPRO can inspect, assess and remediate mold infestation.

SERVPRO can inspect, assess and remediate mold infestation.

Steps Mold Remediation Specialist Take To Remove Mold Growth From Air Ducts

Your commercial property in Vancouver, WA has many places where black mold may hide. All areas that are prone to excess moisture can foster fungus growth. If you believe the problem resides in your HVAC system, there are several steps that mold remediation specialists take to remove the growth and keep it from coming back.

1. Identify Mold Problem

The first thing technicians do is test to confirm that there is mold in your air ducts. There are several signs that this may be the case:

• Fuzzy or slimy patches on insulation

• Black powder on wall outside air vents

• Strong, musty odor

Professional testing gives technicians a lot of information to work with. They know not only the extent of the problem but also the kind of mold they're dealing with. Once they identify the black mold, they can choose better techniques to mitigate it.

2. Clean Ductwork

The main goal of remediation is to leave you with clean ducts throughout your building. Technicians may seal off the system while the cleanup is in progress. This keeps an intense concentration of mold spores from spreading throughout your building and growing elsewhere. After the mold growth is removed, more tests can be run to confirm that the problem is resolved.

3. Resolve Source of Problem

No matter how quickly or thoroughly your remediation specialists remove the mold growth, if you do not take care of the problem that led to it, it is likely to return. Make sure all leaks are fixed. You may need to re-caulk your tile floors or reduce the humidity in your building. Preventing further water damage can also prevent future mold damage.

When you see signs of black mold, you probably need to do more than just wipe it away with a wet cloth. Certified professionals are trained to get rid of the growth and keep it from returning.

Answers to Basic Questions About Interruption Insurance

1/11/2019 (Permalink)

Flooded room in a Vancouver, WA office

Flooded room in a Vancouver, WA office

Even if you've taken all the appropriate steps, your Vancouver, WA, business could still be affected by fire. When this happens, one of the most worrying aspects of the situation is how much money you could lose because of business interruption. Fire isn't the only emergency that could put your business in danger; other financial perils could include extreme weather, hail, windstorms, tornadoes, flooding, and other circumstances that may temporarily close your business. Protect your business with interruption insurance.

What Is Included in the Coverage?

Standard property insurance covers a lot of the physical damages and losses that fire leaves behind, but it doesn't cover everything. There are three main things that business interruption policies cover that your property insurance probably won't.

- Profits you would have earned during the time period

- Operating expenses you're still obligated to pay, such as rent

- Moving costs to your temporary location

Sometimes this type of insurance is called business income insurance.

Who Qualifies for Coverage?

Sadly, there are business owners who don't qualify for this protection. One of the primary qualifications for this type of insurance is a dedicated commercial location. If you run a small business out of your home, you probably won't qualify for the policy. However, you may be able to get a business owner's policy. Other aspects of your business that may affect your eligibility include the type of industry, your history of business interruption claims, and the location.

How Long Does the Interruption Coverage Last?

Fortunately for many business owners, interruption insurance is available for the entire period of restoration. This is defined as the length of time necessary for repairing, rebuilding, and replacing any of your property that is damaged or destroyed. It's a good idea to find out exactly what is covered before you talk to the fire restoration professionals.

As you put safety procedures in place and provide training for your employees, don't forget to research interruption insurance in Vancouver, WA. You'll want the peace of mind that comes from knowing your business won't fail when disaster strikes.

Preventative Maintenance Strategies for Commercial Plumbing

12/31/2018 (Permalink)

No one likes having to deal with plumbing problems. They can cause significant damage to your commercial property that can only be fixed by water remediation experts. When you bring in the experts before the problem starts, however, you can prevent most of the common issues property owners in Felida, WA, tend to have. Being proactive can save you a lot of money and a lot of headaches in the long run.

Keeping a Watchful Eye

Some problems cannot be avoided. For example, if there is a water main break, your building will likely sustain some damage no matter how vigilant you are. Most plumbing issues, however, are easily prevented by recognizing and dealing with them as soon as you discover that something is wrong. A few key things to look out for include:

• Signs of leaks, such as bowed walls, standing water or water marks on the ceiling

• Clogged drains, as evidenced by overflow and slow draining sinks

• Low water pressure readings when you test with a pressure gauge

If you notice the signs of potential plumbing problems, contact someone to further assess and fix them immediately. The sooner a problem is fixed, the less damage it will do.

Have Your Plumbing Inspected

Regular inspections are vital for keeping your plumbing system working properly. Certified professionals can find the broken pipe or root invasion that is causing the problem in your building. With frequent inspections, they may even find it before it causes any damage that you would be able to see. Prevention trumps solution every time.

Taking care of a commercial plumbing system is a big responsibility, but preventing plumbing problems are well worth the effort. Have your plumbing professionally inspected before fall and after winter. It’s also a good idea to perform monthly inspections yourself. By being proactive, you can save yourself a lot of time and money.

Does A Business Need Flood Insurance?

10/19/2018 (Permalink)

Air movers on a flood damage due to storm in a commercial facility in Hazel Dell,WA

Air movers on a flood damage due to storm in a commercial facility in Hazel Dell,WA

Flood insurance is a useful tool to combat the risk of natural disasters, but many business owners do not understand the requirements and basics of these potentially valuable policies. Keep reading for clarification and consideration.

1. Is Insurance Necessary?

While commercial insurance is likely mandatory, coverage for flooding may only be required in some regions of the country. However, just because it is not required does not mean it is not necessary. Only you can be the judge of the necessity of this type of insurance. If your business is located in a low-lying area or an area prone to even small floods, it may be a nice addition to your policy.

2. Does Insurance Protect Against Losses?

Flood insurance may protect against losses caused by flooding. However, there may be specific requirements for that coverage to kick in. For instance, your flood policy may make a stipulation that the flooding is caused by a natural disaster, like the overflowing of lakes, rivers or streams. Some plans may require an overflow to be a certain size before being labeled a flood. For example, many policies agree that water must cover a minimum of 2 acres or affect a minimum of 2 properties before being defined as a flood.

3. Does Insurance Cover Landscaping and Exterior Property Damage?

No, most flood policies do not cover damage done to the exterior of a property, including landscaping and septic systems. Additionally, business interruptions will likely not be covered by this type of policy. There are policies for business interruption as well as additional endorsements that can expand coverage to things like vehicles.

4. Does Insurance Cover Restoration?

Yes, if you have flood coverage, most policies will cover the costs of business restoration. While each policy is different, most will require that you receive a minimum of 3 estimates from restoration companies in the Hazel Dell,WA, area.

While every municipality does not necessarily mandate flood insurance, it may be beneficial for business owners. Ensuring that your property is protected against every potential risk is a way to preserve and maintain operations. Right, not every business needs flood protection, but it may be worth considering.

3 Maintenance Tips To Avoid an Expensive Pipe Break

9/26/2018 (Permalink)

Broken pipe in a Felida, WA shop

Broken pipe in a Felida, WA shop

Making a business claim in Felida, WA, as a result of water damage is often an unpleasant experience. There are various steps you can take as a business owner or manager to maintain your pipes and decrease the likelihood of a pipe break.

1. Monitor Your Bills

Although pipe breaks can occur suddenly, there are often signs that a pipe is damaged before the pipe breaks entirely. Pipe leaks can be a sign that your pipes aren’t working properly, and knowing the cost of your business’s average water bill can help you catch a leaky pipe before it creates too much damage. Keeping a check on your water bills could save you from having to make a business claim at a later date.

2. Be Proactive